Bank CRE Exposure 03-2025

Share:

At Real Treasury, we are cash management experts focused on helping companies optimize treasury functions.

This quarterly bank CRE concentration report is intended to provide visibility into the landscape of financial institution's concentration in CRE.

Many factors must be considered when evaluating the financial health of a financial Institution, we have flagged only a few on this list.

Why CRE Exposure is a Treasury Technology Challenge

CRE exposure affects banks, but corporate treasury teams are impacted downstream—through liquidity access, counterparty risk, and market volatility. The technology challenge arises when treasurers need to:

- Assess Bank Risk Exposure

- Quickly Adjust Liquidity Plans

- Forecast with Confidence

CRE exposure isn’t a tech problem, but managing its ripple effects efficiently is a tech-enabled capability. Treasury teams that lack modern systems for visibility, forecasting, and counterparty management are more vulnerable when these risks surface.

List of Services

-

1. Assess Bank Risk ExposureList Item 1

- Corporate treasurers need to monitor the health of their banking partners.

- Many rely on a handful of core banks. If one has outsized CRE exposure and starts showing stress signals (e.g., higher non-performing assets), the risk of a funding disruption increases.

- Treasury technology becomes critical to track this—not to prevent CRE defaults, but to rapidly reallocate liquidity or adjust exposure based on those risks.

-

2. Quickly Adjust Liquidity PlansList Item 2

- Let’s say your main operating bank is downgraded due to CRE exposure. You might want to:

- Pull excess balances

- Reallocate investments

- Set new limits

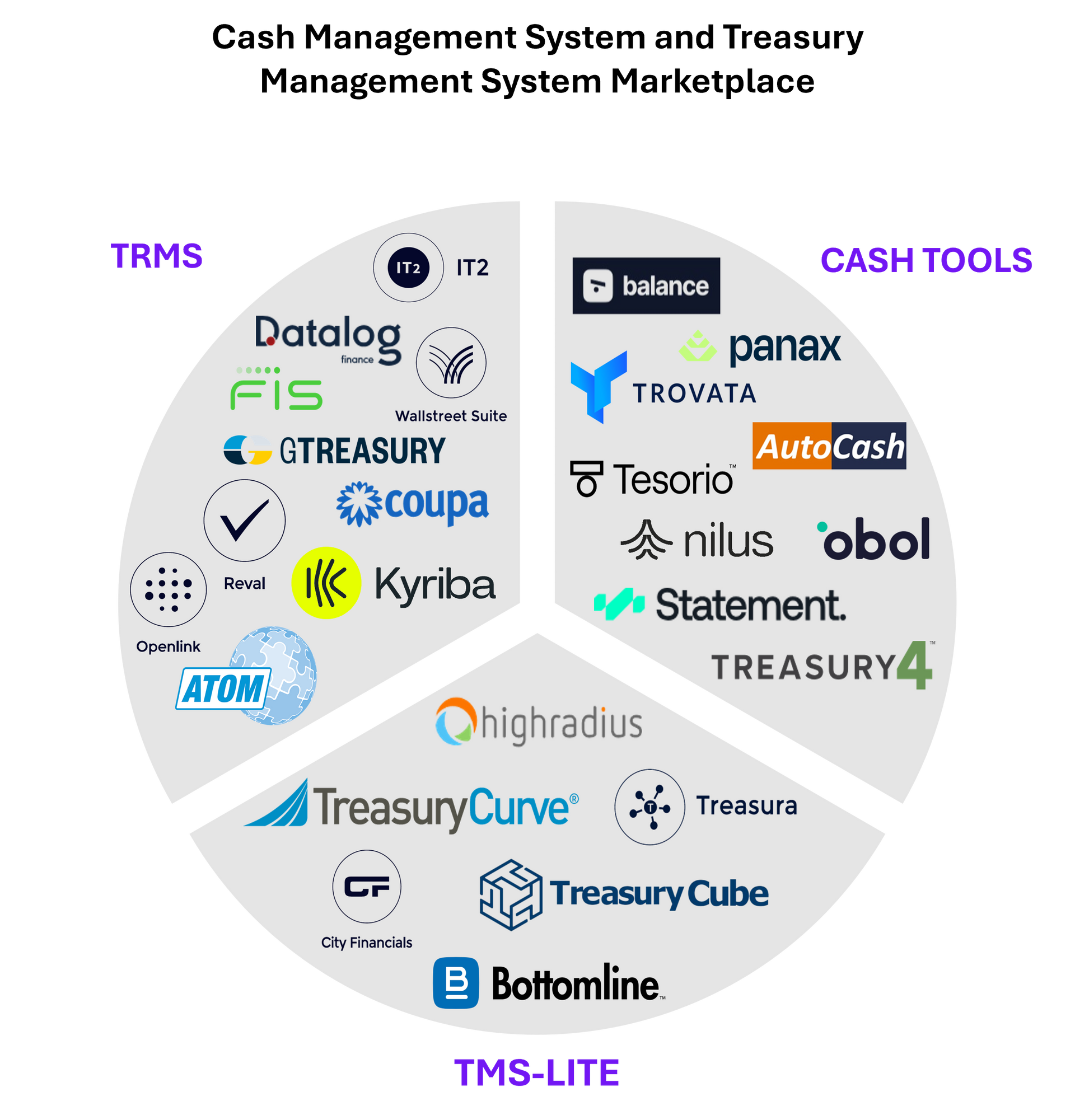

- Treasury Management Systems (TMS) that are siloed, outdated, or not integrated with banking portals slow that down. This is where tech gaps hurt agility.

-

3. Forecast with ConfidenceList Item 3

- A shock to the banking system can quickly become a shock to available liquidity.

- If your forecasting tools can’t simulate this kind of scenario or lack granularity across banking relationships, then you’re flying blind when you need visibility most.

Commercial Real Estate Concentration

Monitoring your financial institution's commercial real estate (CRE) exposure is crucial for maintaining financial stability and mitigating risks. CRE concentration refers to the extent to which your institution is involved in real estate investments, loans, and related activities.

Effective monitoring helps ensure that your firm maintains a balanced portfolio, adheres to regulatory requirements, and makes informed decisions to safeguard its financial health. This proactive approach not only protects your firm's cash but also enhances its ability to respond to market changes and capitalize on opportunities.

Here are a few things to look for when monitoring your bank's CRE concentration

Maintaining Strong Capital Levels

The FDIC emphasizes the importance of maintaining strong capital levels to protect against unexpected losses, particularly in stressed markets. Banks with significant CRE exposures may require more capital due to the elevated risk of unexpected losses caused by uncertain market conditions.

Ensuring Appropriate Credit Loss Allowances

It is crucial for institutions to determine their Allowance for Credit Losses (ACL) in accordance with U.S. GAAP and regulatory reporting instructions. This involves periodic analysis of the collectability of CRE and other exposures, maintaining ACLs at a level appropriate to cover expected credit losses.

Close Management of CRE Loan Portfolios

Institutions should maintain prudent lending standards and credit administration practices, considering the risks of material CRE concentrations. This includes stress testing and sensitivity analysis to prepare for credit risk problems before they impact earnings and capital.

Bank CRE Concentration Report - March 2025

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.