Cash and Treasury Management Systems: A Market Overview

Share:

What are cash and treasury management systems?

Cash and treasury management systems are software solutions that help businesses manage their cash flows, liquidity, and financial risks. They enable companies to optimize their cash positions, forecast their cash needs, automate their payments and collections, and hedge against currency and interest rate fluctuations.

Why are they important?

Cash and treasury management systems are essential for any business that operates across multiple markets, currencies, and banking relationships. They help businesses reduce their operational costs, improve their cash visibility and control, enhance their financial performance, and comply with regulatory requirements.

How is the market segmented?

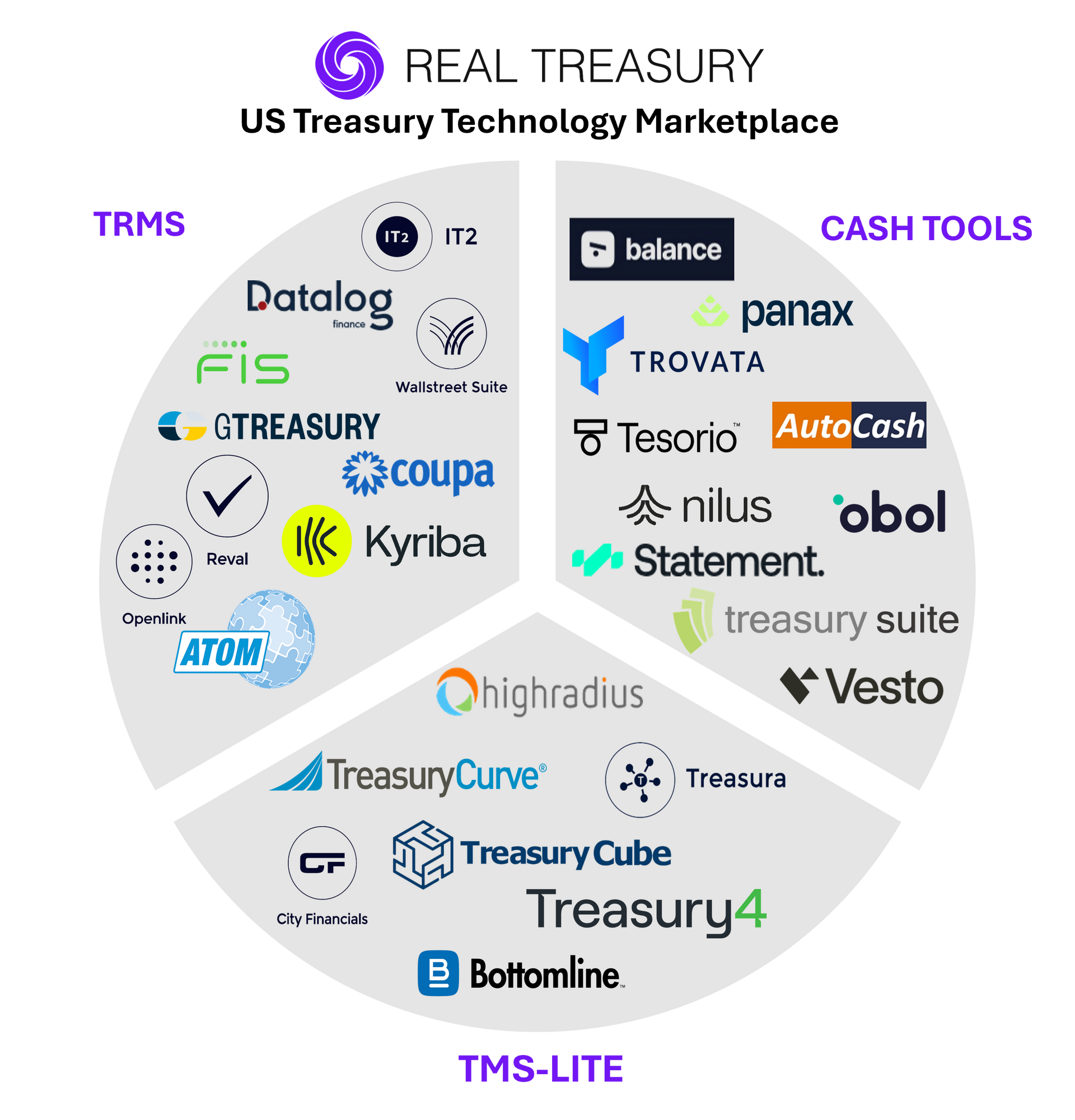

According to our research, the market for cash and treasury management systems in the US and Canada can be divided into three segments, based on the functionality and sophistication they offer. These are:

- Cash management tools: These provide basic cash visibility, forecasting, and reporting, such as bank account balances, cash flows, and cash reports. They are suitable for businesses that have simple cash management needs and limited banking relationships.

- Treasury management systems (Lite): These provide advanced functionality including a central platform for processing treasury payments, transaction level reconciliations, and integrating common market data (FX spot rates). They are suitable for complex businesses that have diverse cash management needs and multiple banking relationships.

- Treasury and risk management systems: These provide comprehensive treasury and risk management capabilities, such as debt and investment management, foreign exchange and interest rate hedging, trade finance, and compliance. They are suitable for businesses that have sophisticated treasury and risk management needs and global banking relationships.

What are the key trends and challenges?

The market for cash and treasury management systems is dynamic and evolving, driven by various factors such as:

- Technology innovation: The emergence of cloud, mobile, artificial intelligence, and blockchain technologies has enabled new and improved features and functionalities, such as real-time data, predictive analytics, and distributed ledger.

- Customer demand: The increasing complexity and volatility of the global business environment has increased the demand for more integrated, flexible, and scalable solutions that can support the changing needs and expectations of customers.

- Regulatory compliance: The growing number of regulations and standards, such as Basel III, Dodd-Frank, and ISO 20022, has increased the need for more transparent, secure, and compliant solutions that can meet regulatory requirements and mitigate risks.

The market for cash and treasury management systems also faces some challenges, such as:

- Data quality: The accuracy and reliability of the data is critical for effective cash and treasury management. However, many businesses still struggle with data quality issues, such as data silos, inconsistencies, and errors.

- System integration: The integration of cash and treasury management systems with other systems, such as enterprise resource planning (ERP), accounting, and banking systems, is essential for seamless and efficient data exchange and workflow automation. However, many businesses still face integration challenges, such as compatibility, interoperability, and customization.

- Cost and complexity: The implementation and maintenance of cash and treasury management systems can be costly and complex. The costs and complexity can vary depending on the size, scope, and complexity of the project, as well as the product, platform, and delivery model.

Finding the right solution to fit your unique business needs is what we do!

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.