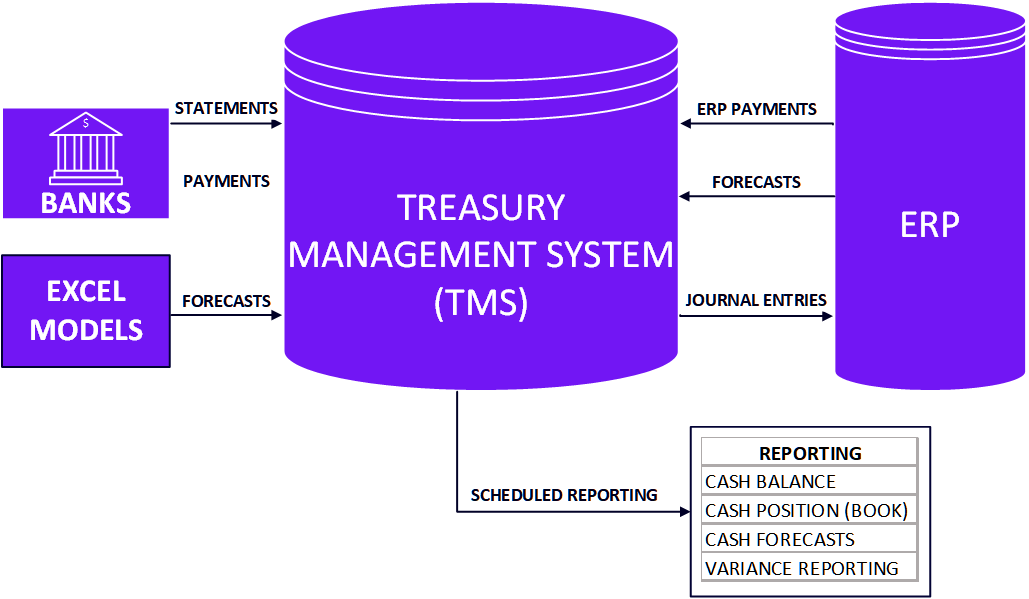

Data Flows of a TMS

Share:

What is a Treasury Management System (TMS)?

A Treasury Management System is a centralized platform for automating treasury processes. A TMS connects data from your banks and data within your ERP system to collect and route the data between each system. By collecting and aggregating your treasury data creates new insights through analytics and process automation.

Common TMS Data Inflows

Bank Transactions

Connecting systems to a TMS plays a crucial role in collecting data which creates a solid foundation for an efficient platform and provides key insights. Integrating more data does not always translate to better analytics. You must decide which data will provide value and which data will be a distraction.

Payment Transactions

A TMS can receive payment transactions for processing from many sources like your ERP system or even Excel. This automates the reconciliation of payments and provides the foundation for streamlined bank recs.

Forecasted Transactions

Adding forecast transactions increases the accuracy of cash reports. By automating cash forecasting, a TMS allows treasury professionals to approach cash forecasting with more confidence and clarity.

Market Data

Integrating with market data providers, a TMS becomes the one-stop solution for all treasury functions.

Common TMS Data Outlows

Reports

Leveraging the data collected, a TMS automates reporting which can take hours when done manually. Cash balances are immediately available, allowing management to execute strategic decisions with confidence.

Payment Transactions

Delivering payment transactions to banks through various payment methods such as ACH, wire, check, or other methods simplifies the payment process and provides key insights for status inquiries and research.

Accounting Transactions

Reconciling at the transaction level allows a TMS to automate the JE posting and improve accounting teams’ efficiency through exception handling.

Trade Transactions

Through connections to trading platforms, whether a simple short-term investment or an FX trade, a TMS is the one-stop solution for treasury.

Data Collection Strategies

Connecting systems to a TMS plays a crucial role in collecting data which creates a solid foundation for an efficient platform and provides key insights. Integrating more data does not always translate to better analytics. You must decide which data will provide value and which data will be a distraction.

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.