Treasury Management System (TMS) Selection Guide: Expert Treasury Consulting Insights

Share:

The Strategic Impact of Treasury Management Systems on Cash Management

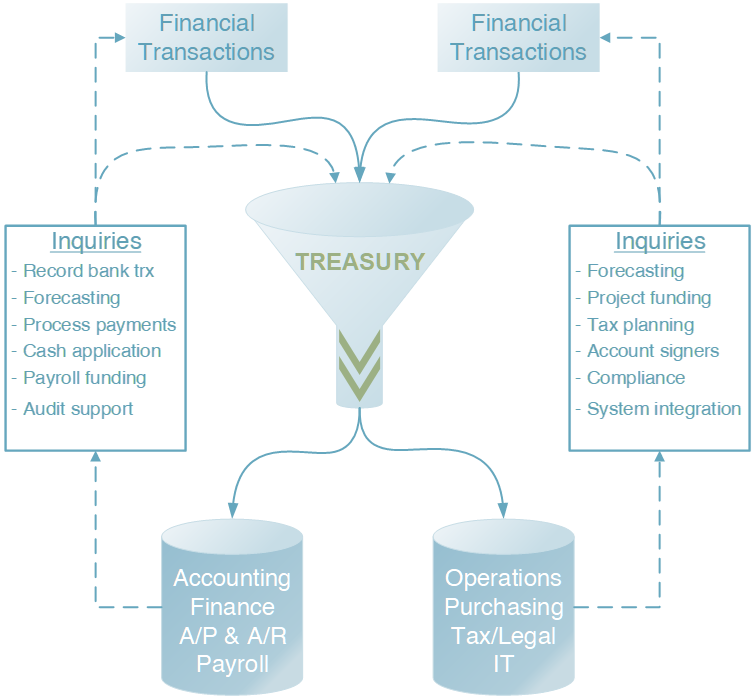

Treasury has a critical role in an organization. Think of the treasury department as the plumbing that moves financial information throughout an organization. Whether there are bank transactions that need to be recorded by accounting, or vendor payments to be processed, information routes through the Treasury team.

Just like plumbing, blockages are bad. Inadequate information flow can result in missed or late payments, idle cash, and other downstream delays. A Treasury Management System (TMS) facilitates the flow of information between parties within an organization.

As treasury consulting experts, we understand that finding and selecting the right TMS is fundamental for optimizing your organization's cash management operations. A well-chosen TMS can significantly impact daily operations, financial investments, and long-term strategic goals. This guide provides our proven approach to selecting and implementing a TMS that aligns with your organization's needs and objectives.

Why TMS Selection Matters

1. A TMS's Critical Impact on Daily Treasury Operations

The system serves as the backbone and of treasury operations, affecting everything from cash management to risk assessment. Treasury teams rely on it for real-time visibility into cash positions, bank account monitoring, and payment processing. When a TMS works efficiently, it streamlines workflows and reduces manual intervention. However, if the system is poorly suited to an organization's needs, it can create bottlenecks, increase operational risks, and hamper productivity.

2. Significant Financial Investment Considerations

Beyond the initial licensing costs, organizations must account for implementation expenses, staff training, system integration, and ongoing maintenance. A TMS implementation can cost anywhere from tens of thousands to millions of dollars, depending on the organization's size and complexity. Most companies end up overpaying given their requirements.

3. Vast and Complex Market Landscape

There are many options, and many companies are unaware of the wide range of available treasury products. The technology landscape continues to grow into what is becoming an overcrowded marketplace, making it difficult to navigate and find the right solution that meets your requirements.

4. Strategic Role in Digital Transformation

A TMS is a cornerstone of treasury digitalization efforts and impacts broader organizational transformation. Modern systems offer capabilities like API connectivity, real-time analytics, and artificial intelligence-driven forecasting. These features can transform how treasury departments operate and contribute to business strategy. The right TMS can enable treasury to evolve from a transactional function to a strategic business partner, providing valuable insights for decision-making and growth planning.

Outdated selection methods can lead to disjointed lengthy processes, misaligned values with vendors, unmet expectations and locked-in subscriptions providing little or no value. Conversely, we have also seen how much of a positive impact SaaS solution (the best ones given your requirements) can make in terms of scalability, growth, and profitability from small businesses to large enterprises alike.

At Real Treasury, we have developed a proven selection process, ERR NOT, to help you select the ideal tools for your unique business. This guide will share some helpful tips along the ERR NOT method journey.

ERR NOT Method Explained

-

E - Education & Early PlanningList Item 1

• Internal Approval: Build the business case and obtain buy in from management.

• Gain understanding of Marketplace: Plan for requirements gathering, vendor research, RFP/RFI process, product demos, vendor evaluation, contract negotiation, and implementation.

• Budget Considerations: Account for software licensing costs, implementation fees, training expenses, ongoing maintenance, bank fees, and integration costs.

-

R - Requirements GatheringList Item 2

• Internal Review: Review and document your current state operations.

• Core Functionality: Determine and prepare written documentation for “must-have” requirements.

• Prioritize Requirements: Rank and prioritize your top requirements.

-

R - RFI/RFPList Item 3

• RFI/RFP Process: Develop a brief RFI document or an RFP (if required) and establish a scoring methodology. We don’t recommend a traditional RFP, but an RFI that focuses on non-functional items.

• RFI Important Inclusion: Don’t overlook critical attributes such as vendor stability, market presence, and support infrastructure.

• Shortlist: Build a vendor shortlist based on price indications and initial demo/discussion.

-

-

N - uNiqueList Item 4

• Custom Demo Script: Create a custom demo script to deliver to all vendors on the shortlist.

• Focus on Requirements: Keep the requirements front and center.

• Product Differentiation: Using a unique demo script will help highlight the strengths and weaknesses of each product.

-

O - Obvious Winner

• Remain Unbiased: Do not get distracted by slick or flashy software (unless it is part of your requirements).

• Post-Demo Evaluation: Scoring process to eliminate confusion and highlight the obvious winner.

-

T - Transformation

• Process Improvement: Move to better or best practices to fully capitalize on the new processes.

• Project Risk Management: Address data migration risks, integration challenges, resource constraints, timeline management, budget control, and change management.

• Success Metrics: Reporting on the success of the project to senior management. Some examples are adoption rates, reporting banks/accounts, time saved, error reduction, cost savings, ROI achievement, and system availability.

• Continuous Improvement: Conduct regular system reviews, collect user feedback, optimize processes, and plan for version upgrades. This should be done at least annually, and more frequently during/after initial implementation.

Why Partner with Real Treasury Consultants

As specialized treasury consultants, we value our partnerships, and our people-first approach transforms your finance and treasury teams. With our knowledge and experience as practitioners, technology vendors, and consultants, we understand the unique landscape and help foster a digital transformation environment for treasury and finance to evolve into strategic value-add functions.

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.