Payment Networks Explained

Share:

What is a "payment"?

A “payment” represents a transfer of value from one party to another in exchange for goods, services, or to fulfill financial obligations. As technology and commerce have evolved, payment methods have diversified significantly, offering various ways to complete these transactions.

What is a Payment Network?

Payment networks are how the two parties communicate financial transaction information. Consider your phone plan with your carrier. Phone companies build cell towers and maintain an infrastructure of transmitters and receivers that allow us to make phone calls.

Just as there are different phone carriers, there are different payment networks. As we journey into payment technology, we will uncover the differences between the networks and how to access the networks.

Payment networks are also often compared to roadways or highways. Let’s unpack this analogy. There are many requirements to drive on the roads. For example:

List of Services

-

1.List Item 1

1. You must have a vehicle that meets the road requirements.

-

List Item 2List Item 2

2. You must have a license to operate a vehicle on the road.

-

List Item 3List Item 3

3. Rules of the road are enforced.

-

List Item 4List Item 4

4. You may even pay a fee to access certain roads via tolls.

-

New List Item

5. Some roads are faster and more expensive than other roads.

-

New List Item

6. Busy roads have specially designed onramps for efficient flow. (yes, this is debatable)

Now replace the word road with network.

List of Services

-

1.List Item 1

1. You must have a vehicle that meets the network requirements.

-----

You need an asset to send through the network, usually cash held at your bank.

-

List Item 2List Item 2

2. You must have a license to operate a vehicle on the network.

-----

Each network monitors their users, often by issuing a unique identifier/account number.

-

List Item 3List Item 3

3. Rules of the network are enforced.

-----

The network enforces its rules on those using the network.

-

List Item 4List Item 4

4. You may even pay a fee to access certain networks via tolls.

-----

Payment networks often charge fees for traveling on the network (per transaction).

-

New List Item

5. Some roads are faster and more expensive than other roads.

-

New List Item

6. Busy networks have specially designed onramps for efficient flow. (yes, this is debatable)

Financial institutions and financial service providers serve as Gateways, providing access to the payment networks with higher cost to access.

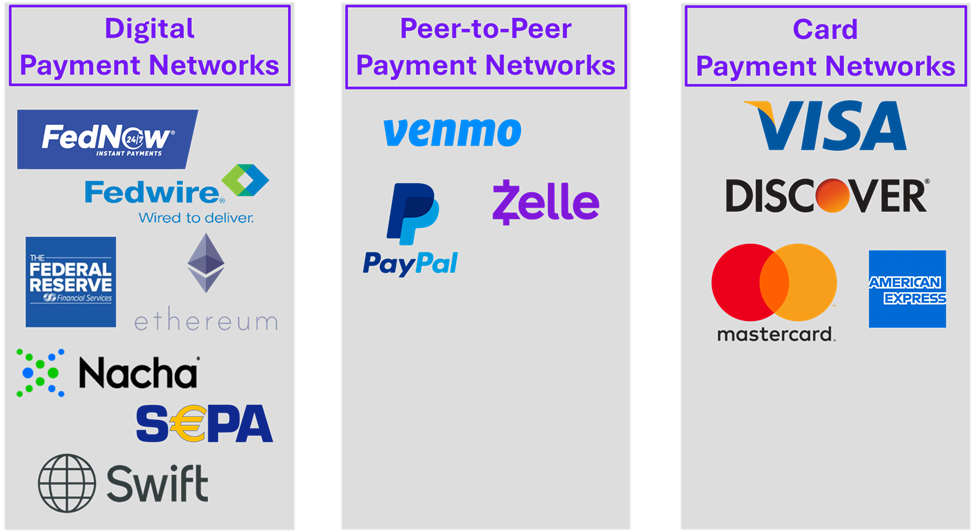

For simplicity, we separate payment networks into three groups:

1. Digital Payment Networks

2. Peer-to-Peer Payment Networks

3. Card Payment Networks

New Payment Technology

Payment networks are a fundamental building block to understanding how new payment technologies allow us to transact in the most efficient and secure way possible. As we continue to explore payment technology, it is essential to understand the intricacies of each network to make informed decisions and optimize financial operations.

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.