Pre-Treasury Explained

Share:

PRE-TREASURY Explained

PRE-TREASURY companies are finance departments that do not have an internal team of treasury specialists.

Treasury functions are typically outsourced to a specialist or performed by generalists who maintain other responsible areas.

- Bookkeeper

- CPA Firm

- Controller

- Accountants

- CFO

- Generalists

- Specialists

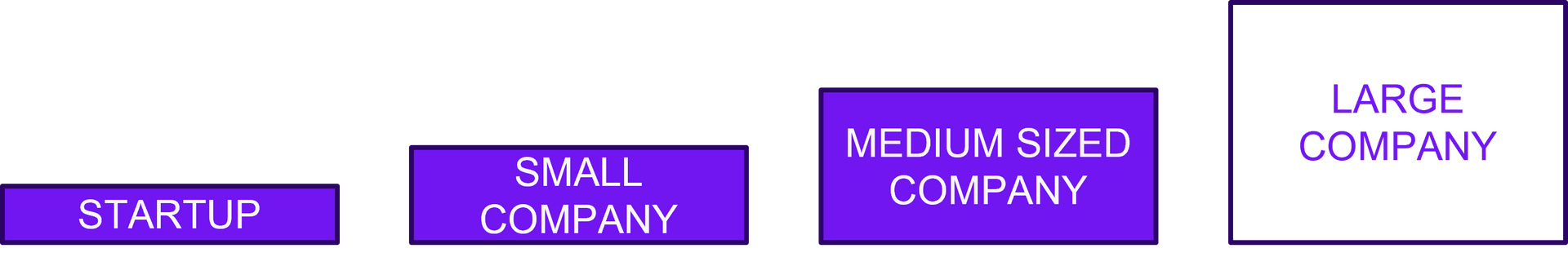

SIMPLE STARTUP

Startup companies typically do not require large finance teams and may consist of a simple bookkeeping service.

REAL TREASURY DIFFERENCE

We help startup companies develop a fundamental cash management strategy and execute best practices.

REAL TREASURY DIFFERENCE

We provide the specialist resources these companies need to scale efficiently.

GAINING MOMENTUM

When businesses need regular financial reporting, a Controller and Accountants are needed. Companies in this stage are still growing rapidly.

GROWING COMPLEXITY

When companies become more complex, they need a Chief Financial Officer to lead its financial strategy. Employees may still have responsibilities across different functions.

REAL TREASURY DIFFERENCE

We help CFOs develop their treasury structure, fill temporary staffing needs, and evaluate technology solutions.

LARGE ENTERPRISES

As companies grow and continue to expand operations, the CFO needs specialists for finance functions such as Treasury, FP&A, Tax and Compliance, and Internal Audit.

REAL TREASURY DIFFERENCE

We help companies optimize in-place TMS, select a TMS or fill gaps with short-term staff.

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.