Real Estate Ownership Explained

Share:

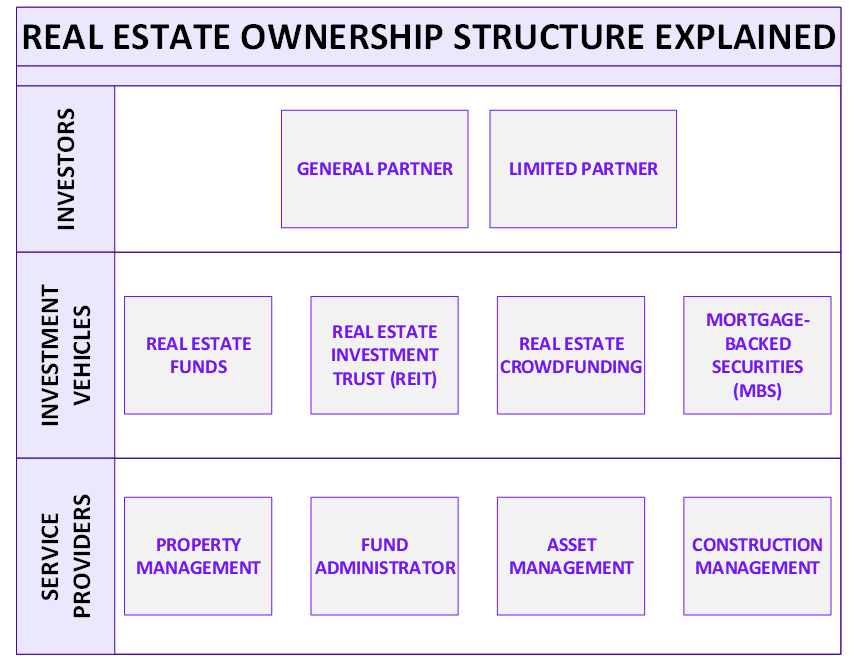

Understanding Real Estate Investment Structures and Service Providers

Real Treasury specializes in helping real estate companies optimize cash management. Our services are designed to help all types and sizes of real estate companies.

Investing in real estate can be a lucrative venture; however, it often involves complex structures and rules. Real estate structures can be very unique, they also include some fundamental aspects. We will explore a few of them like the roles of general and limited partners in real estate investments, a few different types of investment vehicles available, and the essential service providers that help manage and optimize real estate projects. Whether you're an experienced investor or just starting, this guide will provide valuable insights into the world of real estate investment.

General Partner Investors

General partners (GPs) manage and operate investment projects, handling daily activities and key decisions. They have unlimited liability and gain a larger share of the profits due to their active involvement.

List of Services

-

Management and OperationsList Item 1

The GP is responsible for the day-to-day management and operational duties of the real estate project. This includes sourcing and acquiring properties, securing financing, and overseeing the project’s development and operations.

-

Unlimited LiabilityList Item 2

Unlike limited partners, general partners have unlimited liability. This means they are personally liable for the debts and obligations of the partnership.

-

Decision-Making AuthorityList Item 3

General partners have significant decision-making power and control over the partnership’s activities. They make key decisions regarding the management and strategic direction of the project.

-

Active InvolvementList Item 4

GPs are actively involved in the partnership, often referred to as “sponsors” or “developers.” They ensure the project’s financial viability and handle various aspects of the investment.

-

Profit Sharing

While GPs take on more risk, they also stand to gain a larger share of the profits from the real estate project.

Limited Partner Investors

In a real estate structure, limited partners (LPs) are investors who contribute capital to a real estate project but do not participate in its day-to-day management. Here are some key points about limited partners:

List of Services

-

Capital ContributionList Item 1

Limited partners typically provide a significant portion of the capital required for the project, often ranging from 80% to 95%.

-

Limited Liability:List Item 2

Their liability is limited to the amount of their investment. This means they are not personally liable for the debts and obligations of the partnership beyond their initial contribution.

-

Passive RoleList Item 3

Limited partners are generally passive investors. They do not have a say in the daily operations or management decisions of the project. Instead, these responsibilities fall to the general partner(s) who manage the project.

-

Returns and RisksList Item 4

Limited partners can benefit from the profits generated by the real estate investment, but they also share in the risks. The returns can be high, but so can the risks associated with the investment.

-

Control Rights

While they do not manage the project, limited partners often have certain control rights, such as veto power over major decisions, to protect their investment.

Investment Vehicles

An investment vehicle in commercial real estate refers to a legal entity or structure used by investors to pool their capital and invest in commercial properties. They provide investors with the opportunity to diversify their portfolios, gain access to larger and potentially more lucrative properties, and benefit from professional management.

By using an investment vehicle, investors can mitigate risks, leverage economies of scale, and enhance their potential returns while navigating the complexities of commercial real estate markets. These vehicles can take various forms:

Real Estate Funds

These are pooled investment vehicles that invest in real estate properties. They can be structured as partnerships or LLCs and are managed by professional fund managers.

Real Estate Investment Trusts (REIT)

REITs are companies that own, operate, or finance income-producing real estate. They offer investors a way to invest in large-scale, income-generating real estate without having to buy properties directly. These can be either publicly traded and listed on a stock exchange with regular dividends and liquidity to investors or private REITs which can offer higher returns and less liquidity.

Real Estate Crowdfunding

This relatively new investment vehicle allows investors to pool their money online to invest in real estate projects. Crowdfunding platforms provide access to a variety of real estate investments, often with lower minimum investment requirements compared to traditional real estate investments.

Real Estate Mutual Funds

These funds pool money from multiple investors to invest in a diversified portfolio of real estate assets, including REITs, real estate operating companies, and other real estate-related securities. They offer diversification and professional management.

Mortgage-Backed Securities (MBS)

MBS are investment products backed by a pool of mortgages. Investors receive periodic payments derived from the principal and interest payments on the underlying mortgages. MBS can provide exposure to the real estate market without directly owning properties.

Real Estate Syndication

A syndication in commercial real estate is a partnership where multiple investors pool their resources to buy and manage properties. A syndicator organizes the deal, manages the property, and investors provide the capital. In return, investors share in the profits from rental income and property appreciation. This allows access to larger deals and professional management.

Delaware Statutory Trust (DST) | Tenants in Common (TIC)

Investment vehicle for directly owning real estate. These are designed for various tax strategies such as a facilitate the qualification of 1031 like-kind exchange.

Real Estate Investments Service Providers

Each real estate structure is unique a complex, while one may chose to perform certain services internally, another may choose to use a third-party service provider, thus service providers are essential in real estate. They ensure smooth operations and success by handling specific tasks. Following are a few common services which may be internal or external.

List of Services

-

1. Property ManagementList Item 1

A property management company is a business that specializes in managing real estate properties on behalf of owners. Their services typically include:

- Rent Collection: Ensuring timely rent payments from tenants.

- Maintenance and Repairs: Handling routine maintenance and emergency repairs.

- Tenant Relations: Managing tenant communications, lease agreements, and resolving disputes.

- Financial Management: Overseeing the property’s budget, expenses, and financial reporting.

- Marketing and Leasing: Advertising vacancies, screening potential tenants, and managing lease renewals

-

2. Fund AdministratorList Item 2

A fund administrator in a real estate company is a third-party service provider responsible for managing the operational aspects of a real estate investment fund. Their duties typically include:

- Accounting: Maintaining accurate financial records and preparing financial statements.

- Reporting: Providing regular reports to investors and regulatory bodies.

- Compliance: Ensuring the fund adheres to all relevant laws and regulations.

- Investor Relations: Managing communications with investors, including capital calls and distributions.

- Valuation: Independently verifying the assets and valuation of the fund.

-

3. Asset ManagementList Item 3

Asset management in real estate involves strategically managing a property or portfolio of properties to maximize their value and return on investment. Asset managers aim to optimize the financial performance of real estate investments, ensuring they generate consistent and profitable returns. This often includes:

- Sourcing Investments: Identifying and acquiring properties with high potential.

- Financial Oversight: Managing budgets, expenses, and financial performance.

- Risk Management: Mitigating risks associated with property ownership and market fluctuations.

- Value Enhancement: Implementing strategies to increase property value, such as renovations or improved leasing terms.

- Performance Monitoring: Regularly assessing the property’s performance and making adjustments as needed.

-

4. Construction ManagementList Item 4

Construction management is the process of planning, coordinating, and overseeing construction projects from start to finish. It involves several key responsibilities:

- Project Planning: Developing detailed plans, schedules, and budgets for the project.

- Resource Management: Coordinating labor, materials, and equipment to ensure efficient use.

- Quality Control: Ensuring that the construction meets all specifications, codes, and standards.

- Risk Management: Identifying potential risks and developing strategies to mitigate them.

- Communication: Facilitating communication among all stakeholders, including architects, engineers, contractors, and clients.

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.