Treasury Technology for Real Estate Funds

Share:

Treasury Technology for Real Estate

The treasury technology landscape has evolved rapidly in recent years, with emerging high-speed payment methods, API connectivity with real-time data, and artificial intelligence that automates analytical functions. What treasury technology is available for real estate funds and sponsors that creates a competitive advantage?

Automated Cash Reporting

Real estate treasury teams face challenges such as supporting multiple banking relationships, which are driven by the unique capital structures of each deal. While visibility into cash balances across multiple banks is a fundamental responsibility of treasury, this can become quite time-consuming.

A technology solution can automate this process through bank connectivity.

Account Reconciliation

Complex real estate structures with multiple bank accounts present challenges to accounting teams to accurately reconcile the accounts promptly.

Technology today can automate routine transactions and reconciliation. This allows accounting teams to significantly accelerate the monthly close cycle.

Payment Hub

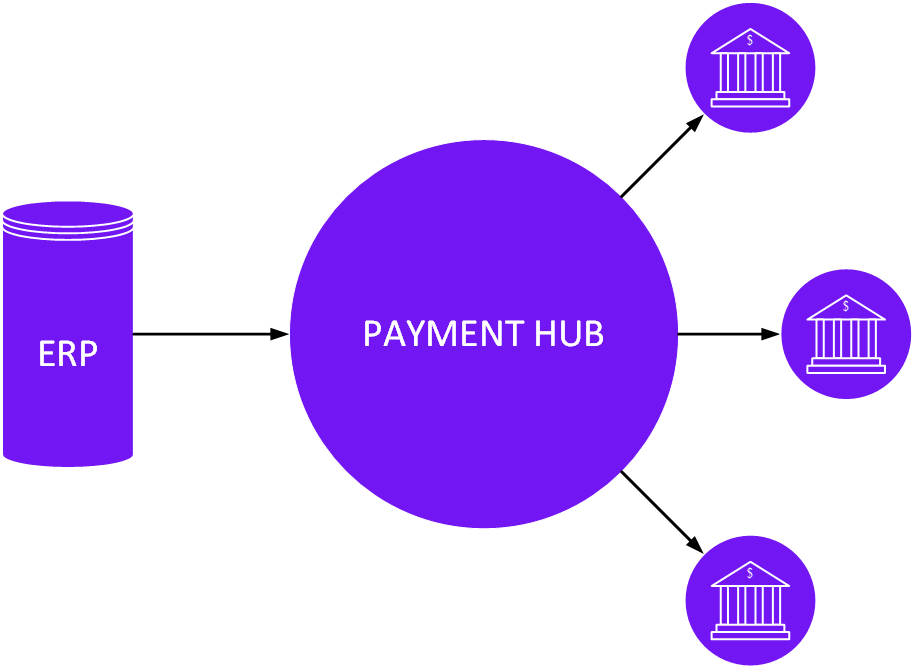

Simplified Connectivity

Connectivity with banks typically requires internal IT resources and can be a very time-consuming process, however, using a central hub in your payment process relieves IT resources and allows faster onboarding of new banking relationships.

Single Source of Record

A payment hub eliminates the need to access multiple bank portals to initiate transactions. Users can initiate and approve payments in a secure centralized system, which stores documentation with auditable workflows.

The above diagram illustrates a payment hub’s position in the payment process, facilitating the delivery of payment files in the required formats for each bank.

Data & Cash Forecasting

Integrated Data

Technology advancements create more data each day; however, not all businesses are equipped to collect and analyze their data. This means businesses are missing key insights.

Do not miss capturing your data by using technology to start building your data history. Analyzing collected data shifts your team from a reactionary response to proactively making strategic data-driven decisions.

Integrating other data sources such as an ERP, or even excel, supplies data unity, and increases forecast confidence.

Single Source of Record

Forecasting cash positions is critical for real estate treasury operations in planning acquisitions, dispositions, or capex deployment.

Cash visibility is the foundation of building an efficient cash forecasting process. Without an accurate starting position, an accurate forecast is unattainable.

Additionally, real-time variance analysis improves the forecasting process, allowing you to increase accuracy and create actionable analytics.

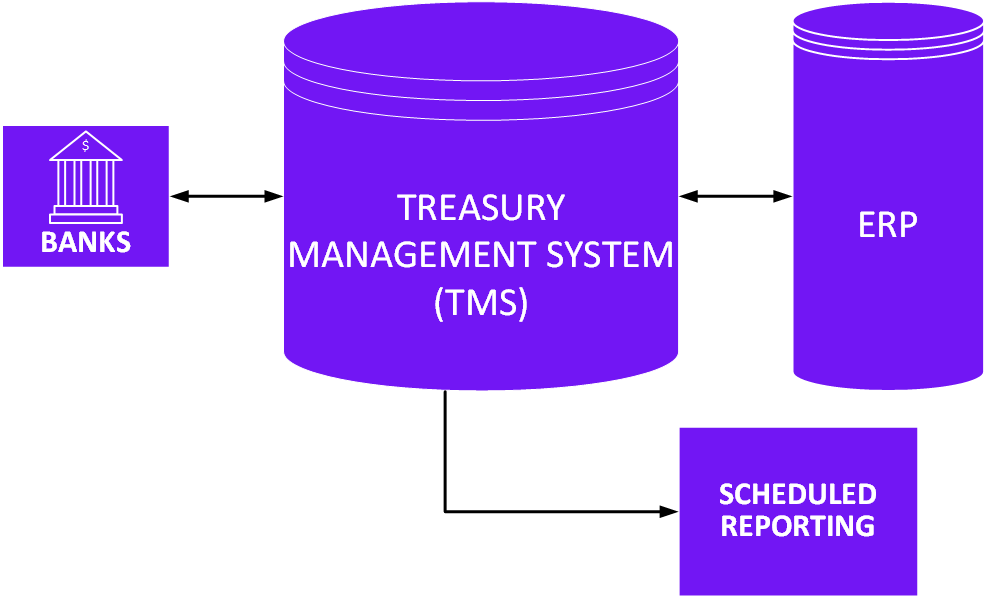

Centralized Treasury Platform

Treasury technology serves as a central platform for all treasury functions and can simplify cash management functions with capabilities such as automated cash pooling, in-house banking, foreign exchange, and investments.

Digital Treasury Strategy

A digital strategy for treasury transforms treasury departments from a cost center to a valued function contributing toward the organization’s strategic goals and is a competitive advantage that allows businesses to offer better customer experiences, through improved customer service, and organization-wide analytics.

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.