Cash Tools Explained

Share:

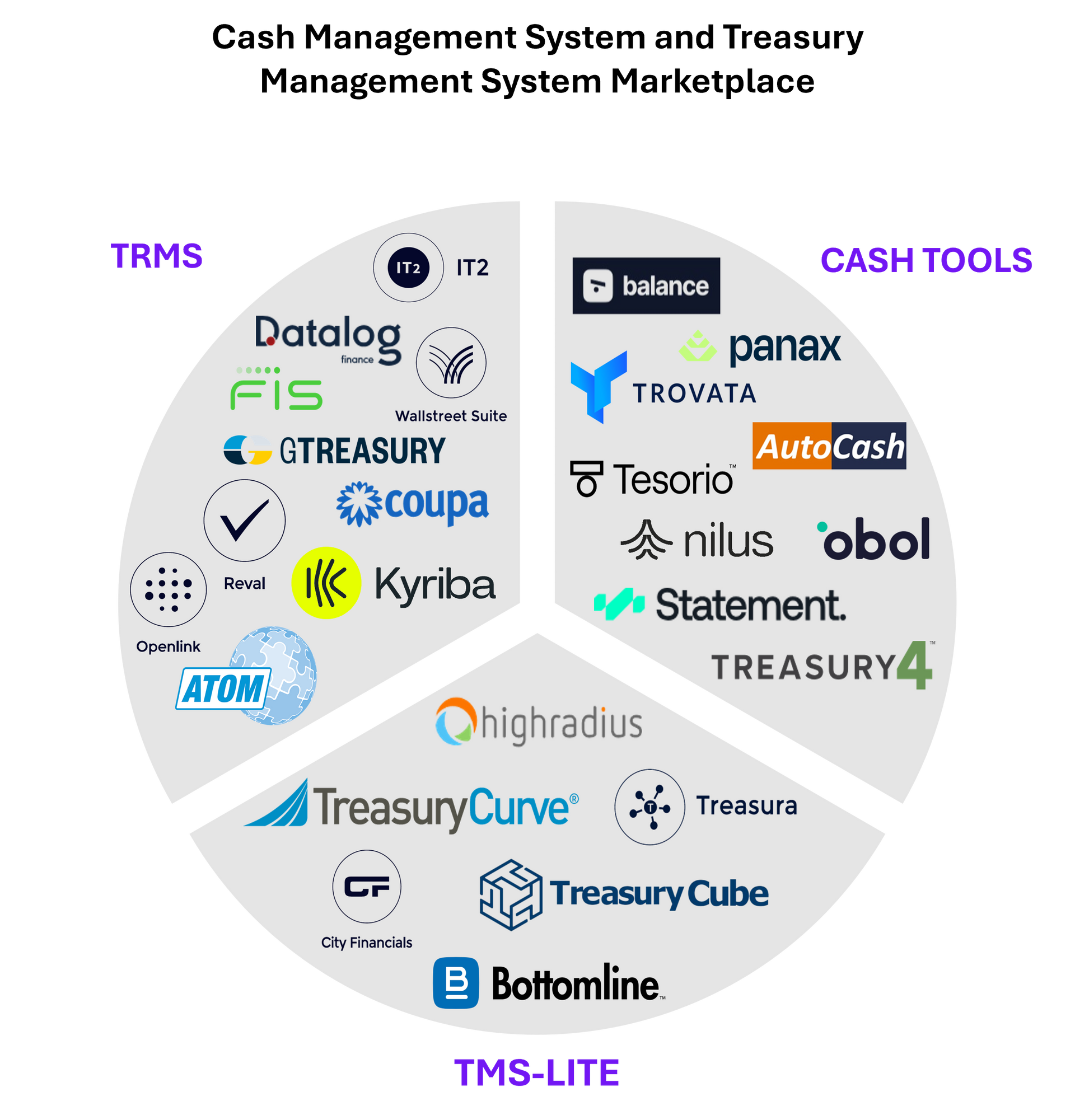

Cash and Treasury Management Systems

Cash and treasury systems are essential software solutions that help businesses manage their cash flows, liquidity, and financial risks. These systems enable companies to optimize their cash positions, forecast their cash needs, automate their payments and collections, and hedge against currency and interest rate fluctuations. The Market Overview provides a brief summary of the different categories of cash and treasury management systems marketed to the US and Canada.

Cash Tools Overview

The Cash Tools category includes products that provide essential functionalities for businesses with simple cash structures and needs. These tools offer a single portal to view bank account balances and transactions. The products in the Cash Tools segment meet the following criteria:

Key Functionality

-

1. Bank ConnectivityList Item 1

There are multiple methods for transmitting information to/from a bank. While some products can provide real-time connections, Previous Day information is typically the minimum required.

- API connections are a type of direct connection, linking 2 databases together by mapping key data fields. These can be faster and more reliable; however, they are not as widely adopted by many regional banks yet.

- SFTP connections are also referred to as Host-to-Host (H2H). This is where each database accesses a secure server where information is exchanged.

-

2. Basic ForecastingList Item 2

Forecasting tools are essential for finance executives. Most companies use spreadsheets that often require lengthy preparation rituals. Having a forecasting tool directly integrated with cash data allows the ability to create and analyze cash flow forecasts and report on variances. Many tools also include scenario analysis and variance analysis features.

- Scenario Analysis lets users compare different versions of a cash forecast, enabling businesses to take proactive measures to manage their liquidity effectively.

- Variance Analysis reporting helps companies compare actual cash flows with forecasted figures, allowing businesses to understand the reasons behind any discrepancies and make necessary adjustments.

-

3. Cash VisibilityList Item 3

Functionality that gives businesses a comprehensive understanding of their cash positions across different accounts, entities, currencies, banks and investments, facilitating better cash management.

- Reducing Idle Cash is a key objective of companies, especially ones with complex entity structures. Having a consolidated view of cash balances helps businesses optimize their cash utilization, reduce idle cash, and ensure that funds are available when needed. It also aids in identifying opportunities for short-term investments or debt repayments.

-

4. Transaction Search, Sort, Tag, GroupList Item 4

Any system or database, is only as valuable as the data stored, retrieved, or processed. Many people use Excel for the ease of accessing and analyzing data. By providing the ability to search, sort, tag, and group transactions, businesses can efficiently manage their cash flows and ensure accurate record-keeping.

Conclusion

Cash Tools are great for businesses with simple cash management needs and limited banking relationships. These tools provide the essential functionalities required to manage cash flows, forecast cash needs, and maintain cash visibility. Some of these products are even designed complex needs and continue to add new functionality.

Cash Tools play a crucial role in helping businesses manage their cash flows, liquidity, and financial risks. By understanding the capabilities of Cash Tools, businesses can make informed decisions about which solutions best meet their requirements. These tools can offer a cost-effective and efficient way to manage cash flows, ensuring that businesses can maintain financial stability and achieve their strategic objectives.

Interested in our services?

We’re here to help!

Book your free 30-minute consultation with one of our experts.